Issued on: 3 Safar 1447

Corresponding to: 28 July 2025

Published in Umm Al-Qura 5099 issued on 1 August 2025.

Issued on: 3 Safar 1447

Corresponding to: 28 July 2025

Published in Umm Al-Qura 5099 issued on 1 August 2025.

Issued on: 26 Muharram 1447

Corresponding to: 21 July 2025

Published in Umm Al-Qura 5099 issued on 1 August 2025.

Issued on: 20 Muharram 1447

Corresponding to: 15 July 2025

Published in Umm Al-Qura 5099 issued on 1 August 2025.

With the help of Allah the Almighty

We, Salman bin Abdulaziz Al-Saud,

the King of the Kingdom of Saudi Arabia,

based on article 70 of the Basic Law of Governance issued by Royal Order O/90 dated 27 Sha’ban 1412 [1 March 1992],

based on article 20 of the Law of the Council of Ministers issued by Royal Order O/13 dated 3 Rabi Al-Awwal 1414 [21 August 1993],

based on article 18 of the Law of the Shura Council issued by Royal Order O/91 dated 27 Sha’ban 1412 [2 March 1992],

after perusal of Shura Council Decision 333/33 dated 27 Dhu Al-Hijja 1446 [23 June 2025],

and after perusal of Council of Ministers Decision 42 dated 13 Muharram 1447 [13 August 2025],

The Law of Real Estate Ownership by Non-Saudis is hereby approved in the form attached.

The entry into force of the law—referred to in clause First of this decree—does not prejudice the following:

1․ Real estate property rights that have been legally established for a non-Saudi and for a legal person before the entry into force of its provisions.

2․ The legal provisions that prevent the ownership of real estate in specific places, areas, and locations, taking into account the provisions of paragraph 1 of this clause.

Royal Decree 44 dated 29 Dhu Al-Qa’dah 1377 [16 June 1958] is hereby repealed.

His Royal Highness the Prime Minister, the ministers, and the heads of independent concerned authorities—each within their area of competence—shall implement this decree of Ours.

Salman bin Abdulaziz Al-Saud

Issued on: 19 Muharram 1447

Corresponding to: 14 July 2025

Published in Umm Al-Qura 5098 issued on 25 July 2025.

Issued by Royal Decree D/14

The following words and phrases—wherever they appear in this law—have the meanings assigned to each of them:

Law:

The Law of Real Estate Ownership by Non-Saudis.

Regulation:

The executive regulation of the law.

Authority:

The Real Estate General Authority.

Non-Saudi:

1․ A natural person who does not hold Saudi nationality.

2․ A non-Saudi company.

3․ A non-Saudi non-profit entity.

4․ Any other non-Saudi legal person determined by a decision of the Council of Ministers.

1․ A non-Saudi may own real estate or acquire other rights in rem over real estate in the Kingdom, within the geographical scope specified by the Council of Ministers by virtue of paragraph 2 of this article.

2․ The following must be determined by a decision of the Council of Ministers, based on a proposal by the board of directors of the authority and the approval of the Council of Economic and Development Affairs:

(a) The geographical scope in which a non-Saudi may own real estate or acquire other rights in rem over real estate.

(b) The types of rights in rem over real estate that a non-Saudi may acquire.

(c) The maximum non-Saudi ownership percentage in the geographical scope.

(d) The maximum grace period allowed for the acquisition of the usufruct right over real estate for a non-Saudi.

(e) Any controls relating to the ownership of real estate by a non-Saudi or the acquisition of rights in rem over it.

3․ In addition to the rights of non-Saudis stipulated in paragraphs 1 and 2 of this article, a natural non-Saudi who legally resides in the Kingdom may own one real estate designated for his residence outside the geographical scope referred to in paragraph 2 of this article, with the exception of the cities of Makkah Al-Mukarramah and Al-Madinah Al-Munawwarah. The regulation must specify the provisions of this paragraph.

4․ The right of a non-Saudi to own real estate or acquire other rights in rem—referred to in paragraph 1 of this article—over real estate in the cities of Makkah Al-Mukarramah and Al-Madinah Al-Munawwarah is limited to a natural person who is a Muslim.

1․ A company not listed on the Saudi Stock Exchange established in accordance with the provisions of the Saudi Companies Law, and whose capital is jointly owned by one or more natural or legal persons who do not enjoy Saudi nationality, may own real estate or acquire other rights in rem over real estate, within the geographical scope referred to in article 2(2) of the law, including the cities of Makkah Al-Mukarramah and Al-Madinah Al-Munawwarah.

2․ Subject to the provisions of paragraph 1 of this article and any privileges granted by other laws, the company referred to in paragraph 1 of this article may own real estate or acquire other rights in rem over real estate necessary for the exercise of its activities and for the housing of its employees, within or outside the geographical scope referred to in article 2(2) of the law, as specified by the regulation.

Companies listed on the Saudi Stock Exchange established in accordance with the provisions of the Companies Law, investment funds, and special purpose vehicles licensed by law, may own real estate and acquire other rights in rem over real estate in the Kingdom—including the cities of Makkah Al-Mukarramah and Al-Madinah Al-Munawwarah—in accordance with the provisions of the Capital Market Law and its executive regulations, and the controls set by the Capital Market Authority in coordination with the Real Estate General Authority and other relevant entities.

The application of the law does not prejudice the provisions of the Premium Residency Law, the System of the Ownership of Real Estate by Nationals of the States of the Council in the Member States of the Cooperation Council for the Purpose of Housing and Investment, or other applicable laws that grant non-Saudis more favorable rights with regard to the ownership of real estate and the acquisition of other rights in rem over it.

The ownership of real estate by a non-Saudi or the acquisition of other rights in rem over real estate in the Kingdom does not result in any rights or privileges other than the rights prescribed for the owner of the right in rem by law.

It is permitted—on the basis of reciprocity—for diplomatic representations accredited in the Kingdom to own their official headquarters and the residence of their head and members, and it is permitted for international and regional bodies—to the extent required by the agreements governing them—to own their official headquarters, provided that the approval of the Ministry of Foreign Affairs is obtained.

1․ A non-Saudi company, a non-Saudi non-profit entity, or a non-Saudi entity specified by a decision of the Council of Ministers—referred to in paragraphs 2, 3, and 4 of the definition of a non-Saudi—shall register with the competent entity before owning real estate or acquiring other rights in rem over real estate in the Kingdom, as specified by the regulation.

2․ The ownership of real estate by a non-Saudi or the acquisition of other rights in rem over real estate in the Kingdom is valid after its registration with the Real Estate Registry in accordance with the provisions governing this.

Without prejudice to any fees or taxes prescribed by law, a fee collected by the authority on the value of the non-Saudi’s disposal of rights in rem over real estate in the Kingdom must be imposed, not exceeding 5% of that value.

1․ Without prejudice to any punishment more severe stipulated in any other law, whoever violates the provisions of the law or the regulation must be punished by any of the following:

(a) Warning.

(b) A fine not exceeding 5% of the value of the right in rem subject of the violation, not exceeding 10,000,000 (ten million) Riyal.

2․ The regulation must specify a schedule of violations and the punishments prescribed for them based on the provisions of the law and the regulation. The punishment must be determined based on the gravity of the violation and its circumstances, facts, and impact.

1․ A committee (or more) of not less than three members, specialized in law, must be formed by a decision of the board of directors of the authority, and it shall examine the violations and impose the punishments provided in article 10 of the law.

2․ The work rules of the committee, its procedures, and the remuneration of its members must be determined by a decision by the board of directors of the authority.

3․ It is permitted to object to the decisions of the committee before the Administrative Court within 60 days from the date of being notified of them.

1․ As an exception to article 10 of the law and without prejudice to any punishment more severe stipulated in any other law, a non-Saudi who deliberately provides incorrect or misleading information that leads to his ownership of the real estate or his acquisition of any of the other rights in rem over the real estate must be punished by the following:

(a) A fine not exceeding 5% of the value of the right in rem subject of the violation, not exceeding 10,000,000 (ten million) Riyal.

(b) Sale of the right in rem over the real estate.

2․ The Public Prosecution has the mandate to investigate and prosecute the act referred to in paragraph 1 of this article, and the competent court shall examine this and impose the punishment.

3․ If the court rules to sell the right in rem in accordance with paragraph 2 of this article, the price of the right in rem or the amount paid for its acquisition must be returned to the perpetrator of the act—after deducting the fines, any other taxes or fees prescribed by law, and the expenses of the sale from it—whichever is less, and the remainder of the proceeds of the sale must be transferred to the public treasury of the state.

1․ The Council of Ministers shall issue the regulation—based on a proposal by the board of directors of the authority and the approval of the Council of Economic and Development Affairs—within 180 days from the date of publication of the law in the official gazette, and it becomes effective from the date of entry into force of the law.

2․ The regulation must specify:

(a) Procedures for the acquisition of rights in rem over real estate in the Kingdom by a non-Saudi.

(b) Requirements for the implementation of the provisions of the law prescribed for non-Saudis who are not resident in the Kingdom.

(c) The amount of the fee mentioned in article 9 of the law, provided that it is determined based on the type of right in rem of the real estate, its purpose, and the geographical scope.

(d) Disposals subject to zero fee and the cases, conditions, and controls necessary for this.

This law replaces the Law of Real Estate Ownership and Investment by Non-Saudis issued by Royal Decree D/15 dated 17 Rabi Al-Thani 1421 [19 July 2000], and repeals provisions in conflict with it.

The law comes into force after 180 days from the date of its publication in the official gazette.

Published in Umm Al-Qura 5098 issued on 25 July 2025.

The Minister of Finance,

Chairman of the Board of Directors of the Zakat, Tax, and Customs Authority

based on the powers entrusted to him by law,

after perusal of article 11 of the Common Customs Law of the States of the Cooperation Council for the Arab States of the Gulf issued by Royal Decree D/41 dated 3 Dhu Al-Qa’dah 1423 [6 January 2003], which stipulates that customs duties are imposed, amended, and repealed by the legal instrument in force in each of the member states, taking into account the decisions issued by the council states in this regard and the provisions of the international agreements in force,

after perusal of Royal Decree D/98 dated 18 Shawwal 1443 [23 May 2022], which stipulates in clause First the approval of the authorization of the Minister of Finance, Chairman of the Board of Directors of the Zakat, Tax, and Customs Authority, to issue decisions approving the implementation of the decisions amending the customs tariff category issued within the framework of the Cooperation Council for the Arab States of the Gulf, and to determine the date of their entry into force, after completing the legal procedures for these decisions within the framework of the council, and to inform the Council of Ministers of this,

after perusal of Royal Decree D/39 dated 25 Rabi Al-Thani 1442 [1 December 2020], which stipulates in clause First that it is permitted by a decision by the Minister of Finance, Chairman of the Board of Directors of the Zakat, Tax, and Customs Authority, to amend the category of customs duties for the purpose of protecting and encouraging national industries and local agricultural products, in accordance with the ceilings to which the Kingdom has committed in the World Trade Organization,

after perusal of Council of Ministers Decision 559 dated 28 Sha’ban 1441 [28 March 2020], which stipulates that the customs tariff for the goods shown in the lists attached to the mentioned Council of Ministers decision must be in accordance with the ceilings to which the Kingdom has committed in the World Trade Organization, Ministerial Decisions 59334 dated 10 Dhu Al-Qa’dah 1443 [10 June 2022] and 1-88-1446 dated 5 Muharram 1446 [12 July 2024], which stipulate the amendment of the category of fees for a number of goods, for the purpose of protecting and encouraging national industries and agricultural products, in accordance with the ceilings to which the Kingdom has committed in the World Trade Organization,

and after perusal of Financial and Economic Cooperation Committee decision in its Meeting 123 held on 5 Dhu Al-Hijja 1446, corresponding to 1 June 2025,

The continued extension of the amendment to the category of customs duties on Reinforcing Steel 7214 and Iron Coils 7213 from 5% to 10% is hereby approved for a period of one year from the date of adoption of the Financial and Economic Cooperation Committee Minutes 123 dated 1 June 2025, and any subsequent decision issued by the committee regarding the extension of the implementation of its mentioned decision.

The provisions of clause First of this decision do not prejudice any decisions relating to the amendment of the category of customs duties to protect and encourage national industries and agricultural products.

This decision must be published in the official gazette, and it must be communicated to those required to implement it.

Mohammed bin Abdullah Al-Jadaan

Minister of Finance

Chairman of the Board of Directors of the Zakat, Tax, and Customs Authority

Issued on: 17 Muharram 1447

Corresponding to: 12 July 2025

Published in Umm Al-Qura 5097 issued on 18 July 2025.

The Minister of Environment, Water, and Agriculture,

based on the powers entrusted to him by law, based on article 9(1) of the Water Law issued by Royal Decree D/159 dated 11 Dhu Al-Qa’dah 1441 [2 July 2020], the Conditions and Controls for Issuing Licenses for Groundwater Sources (Wells) and Classifying Their Violations, adopted by Ministerial Decision 5216262 dated 24 Rajab 1445 [1 August 2024], and with reference to the proposal of the Undersecretary of the Ministry of Water in letter 25281907 dated 1 Muharram 1447 [15 July 2025], accompanied by the Controls for Issuing Licenses for Drilling New Wells on the Sedimentary Shelf (non-renewable groundwater) for specialized agricultural and animal projects, and in pursuance of public interest,

The Controls for Issuing Licenses for Drilling New Wells on the Sedimentary Shelf (non-renewable groundwater) for specialized agricultural and animal projects are hereby approved in the form attached to the decision.

The Office of the Undersecretary of the Ministry for Water shall update the Controls for Issuing Licenses for Drilling New Wells on the Sedimentary Shelf (non-renewable groundwater) for specialized agricultural and animal projects, and exempt what it deems appropriate, in accordance with the Water Law and its executive regulation, and submit it for approval.

This decision comes into force on the date of its publication in the official gazette, and it must be communicated to those required to implement it and act by virtue of it, and it hereby repeals all previous decisions in conflict with it.

Minister of Environment, Water, and Agriculture

Engineer Abdulrahman bin Abdulmohsen Al-Fadley

Issued on: 14 Muharram 1447

Corresponding to: 9 July 2025

Published in Umm Al-Qura 5097 issued on 18 July 2025.

Issued by Ministry of Environment, Water, and Agriculture: Decision 15011232.

The drilling of new wells on the sedimentary shelf (non-renewable groundwater) is hereby permitted for licensed specialized agricultural and animal projects, and with limited consumption of the following water:

1․ Poultry projects and their equivalent.

2․ Livestock feedlot projects.

3․ Poultry slaughterhouses.

4․ Red meat factories.

5․ Fodder factories.

6․ Vertical farming.

7․ Hydroponics.

8․ Greenhouses.

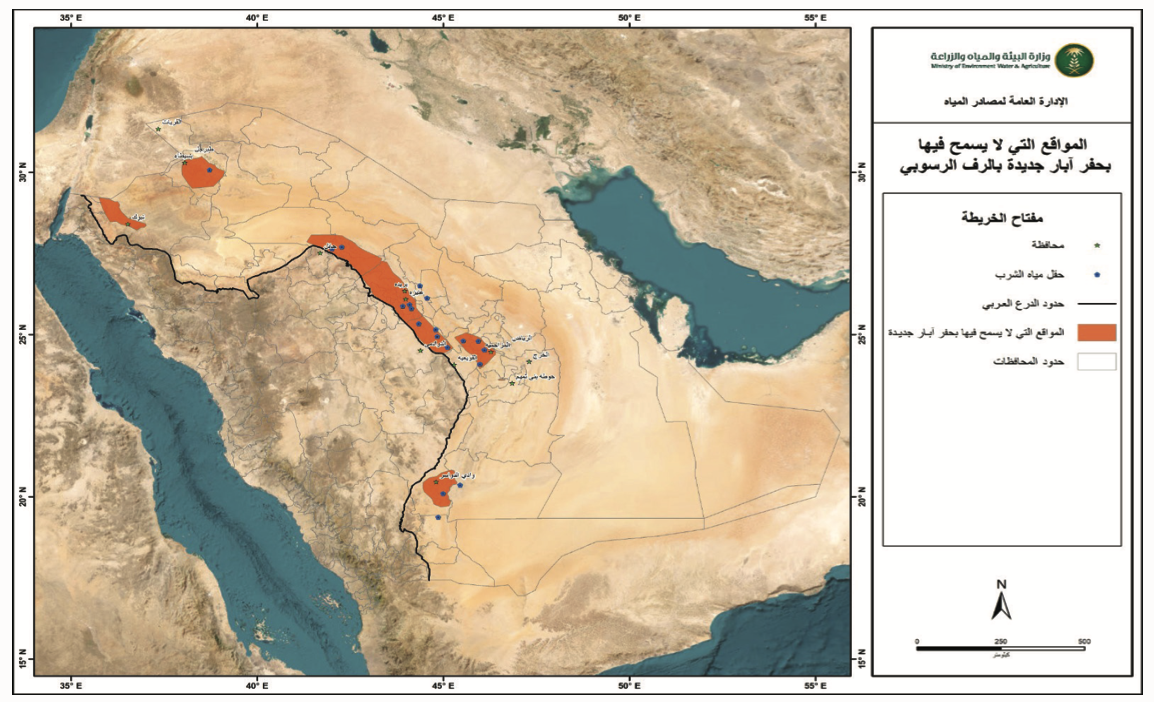

The following are excluded from the permission referred to in article 1, the layers specified in the attached water map that suffer from a sharp decline in water levels, and there are many drinking water projects and intensive agricultural activity on them, which are:

1․ Manjur layer in Muzahmiyah and Dhurma.

2․ Wajid layer in Wadi Al-Dawasir.

3․ Taweel layer in Basita.

4․ Sites located on or near the outcrops of the Saaq layer in Riyadh, Qassim, Hail, and Tabuk.

Lands licensed to establish any of these projects must be owned by their owners under an updated and valid deed, a long-term lease contract (ten years) under an updated and valid deed and endorsed by the Ministry of Justice, or a lease contract issued by the ministry, and must not conflict with the sites where it is not permitted to drill wells according to the attached map or with the prohibited areas or areas of drinking water sources.

The conditions and controls for issuing licenses for groundwater sources (wells) adopted by ministerial decisions must be completed.

The agricultural project must be established on at least 50% of the basic components of the project.

An environmental compliance certificate must be submitted for agricultural projects that require it.

The number of wells licensed to be drilled for any agricultural project must not exceed two wells only. In the event of future need, deepening and cleaning services and drilling an alternative well may be permitted in the event that the project well is out of service, in accordance with the conditions and controls for issuing licenses for groundwater sources (wells).

It is not permitted to change the type, nature, or area of the project or add another activity other than those licensed to do so, except after obtaining an updated license to use the water source, in accordance with the conditions and controls governing this.

Published in Umm Al-Qura 5097 issued on 18 July 2025.

The Council of Ministers,

after perusal of Royal Court File 1180 dated 5 Muharram 1447 [30 June 2025], regarding the draft Law of Real Estate Ownership by Non-Saudis,

after perusal of the mentioned draft law,

after perusal of Royal Decree 44 dated 29 Dhu Al-Qa’dah 1377 [16 June 1958],

after perusal of the Law of Real Estate Ownership and Investment by Non-Saudis issued by Royal Decree D/15 dated 17 Rabi Al-Thani 1421 [19 July 2000],

after perusal of the System of the Ownership of Real Estate by Nationals of the States of the Council in the Member States of the Cooperation Council for the Purpose of Housing and Investment issued by Royal Decree D/22 dated 3 Rabi Al-Thani 1432 [8 March 2011],

after perusal of Bureau of Experts at the Council of Ministers Memorandum 3290 dated 12 Ramadan 1445 [22 March 2024], Memorandum 4230 dated 7 Dhu Al-Hijja 1445 [13 June 2024], Memorandum 150 dated 9 Muharram 1446 [15 July 2024], Memorandum 3404 dated 17 Shawwal 1446 [15 April 2025], Memorandum 4135 dated 23 Dhu Al-Hijja 1446 [19 June 2025], Memorandum 4152 dated 26 Dhu Al-Hijja 1446 [22 June 2025], and Memorandum 47 dated 8 Muharram 1447 [3 July 2025],

after perusal of Political and Security Affairs Council Minutes MST/91-46/9 dated 29 Ramadan 1446 [29 March 2025],

after perusal of Council of Economic and Development Affairs Recommendation 73-43/46/D dated 29 Shawwal 1446 [27 April 2025],

after considering Shura Council Decision 333/33 dated 27 Dhu Al-Hijja 1446 [23 June 2025],

and after perusal of General Committee of the Council of Ministers Recommendation 312 dated 11 Muharram 1447 [6 July 2025],

The Law of Real Estate Ownership by Non-Saudis is hereby approved in the form attached.

The entry into force of the law referred to in clause First of this decision does not prejudice the following:

1․ Real estate property rights that have been legally established for a non-Saudi and for a legal person before the entry into force of its provisions.

2․ The legal provisions that prevent the ownership of real estate in specific places, areas, and locations, taking into account the provisions of paragraph 1 of this clause.

Royal Decree 44 dated 29 Dhu Al-Qa’dah 1377 [16 June 1958] is hereby repealed.

A draft royal decree has been prepared in the form attached.

The legal procedures must be undertaken to cancel the application of the provisions of article 4 of the System of the Ownership of Real Estate by Nationals of the States of the Council in the Member States of the Cooperation Council for the Purpose of Housing and Investment issued by Royal Decree D/22 dated 3 Rabi Al-Thani 1432 [8 March 2011] relating to real estate located within the cities of Makkah Al-Mukarramah and Al-Madinah Al-Munawwarah, provided that the cancellation is effective from the date of entry into force of the law referred to in clause First of this decision.

The Prime Minister

Issued on: 13 Muharram 1447

Corresponding to: 8 July 2025

Published in Umm Al-Qura 5098 issued on 25 July 2025.

With the help of Allah the Almighty

We, Salman bin Abdulaziz Al-Saud,

the King of the Kingdom of Saudi Arabia,

based on article 70 of the Basic Law of Governance issued by Royal Order O/90 dated 27 Sha’ban 1412 [1 March 1992],

based on article 20 of the Law of the Council of Ministers issued by Royal Order O/13 dated 3 Rabi Al-Awwal 1414 [20 August 1993],

based on article 18 of the Law of the Shura Council issued by Royal Order O/91 dated 27 Sha’ban 1412 [1 March 1992],

after perusal of Shura Council Decision 227/21 dated 10 Ramadan 1446 [19 March 2025],

and after perusal of Council of Ministers Decision 15 dated 6 Muharram 1447 [1 July 2025],

Clause Third of Royal Decree D/83 dated 25 Rajab 1439 [11 April 2018] issued regarding the approval of the Constitution for the Saudi Arabian Boy Scouts Association is hereby amended to read as follows:

1․ As an exception to the provisions of article 21 of the law mentioned in clause First, the first board of directors of the association must be formed of nine members for a period of three years as follows:

(a) Five members appointed by order of the Prime Minister, based on a nomination by the Minister of Education, including the chairman of the board.

(b) Four members elected by the general assembly in accordance with article 21(1) of the constitution mentioned in clause First.

The Prime Minister may extend the term of this board for a similar period and for one time only.

2․ The existing board of directors of the association—at the time of entry into force of the constitution—shall continue to perform the tasks entrusted to it, until a new board of directors is formed in accordance with paragraph 1 of this clause.

3․ The board of directors—mentioned in paragraph 2 above—shall call the general assembly to convene within 120 days to elect the members mentioned in paragraph 1(b) above.

4․ The entry into force of the constitution—mentioned in clause First—does not prejudice the continuation of the membership of the members of the Saudi Arabian Boy Scouts Association before the entry into force of that constitution.

His Royal Highness the Prime Minister, the ministers, and the heads of independent concerned authorities—each within their area of competence—shall implement this decree of Ours.

Salman bin Abdulaziz Al-Saud

Issued on: 13 Muharram 1447

Corresponding to: 8 July 2025

Published in Umm Al-Qura 5097 issued on 18 July 2025.